15 Jun Inland Revenue letters regarding incorrect PIR

Following system changes that Inland Revenue implemented in April, they are now able to identify customers with PIE investments who appear to be on an incorrect PIR.

As part of the new automatic income tax assessment process, customers who Inland Revenue think are on an incorrect PIR will receive a letter letting them know either:

- that their PIR is too low and they may have tax to pay which will be included in their automated tax assessment; or

- that their PIR is too high and they will be unable to claim a refund.

The letter tells them to get in touch with their PIE provider to update their PIR so that they are paying the right amount of tax for the future.

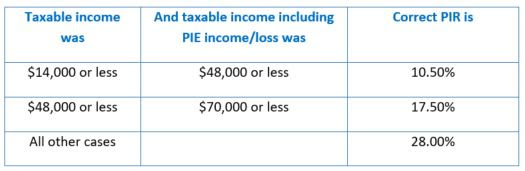

You can work out what PIR they should be on by using the following table:

If you’re not sure what your current code is or if you’d like to change your code, please get in touch.