07 Feb Towards Prosperity: Financial Services valuable to NZ

New research released by the Financial Services Council has revealed the true contribution of the broader financial services sector to New Zealand’s economic wellbeing.

The research ‘Towards Prosperity’ carried out by the New Zealand Institute of Economic Research is some of the most comprehensive to date carried out on the sector and demonstrates not just its contribution, but also dispels some common myths.

The report is a snapshot in time and highlights the key contributions of the broader Financial Services sector to the economic wellbeing of the country.

There are a number of key findings about the financial services industry that this research has highlighted:

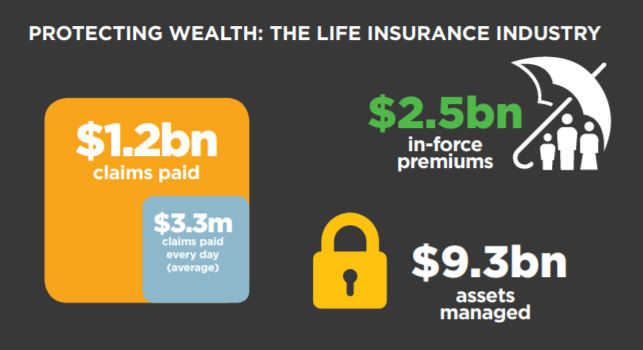

1. The Financial Services sector supports the wider New Zealand economy and plays an important part in supporting all New Zealand industries

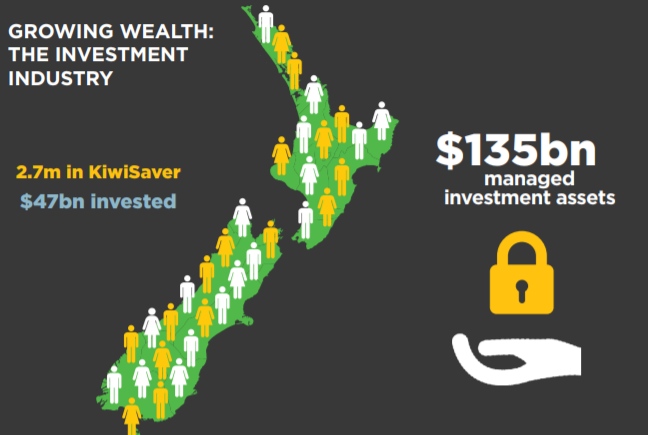

The research found that 60% of KiwiSaver managed funds are re-invested locally, and that Financial Services have a unique role in supporting the production of other New Zealand industries, for such as either protecting them through insurance or helping them invest for growth.

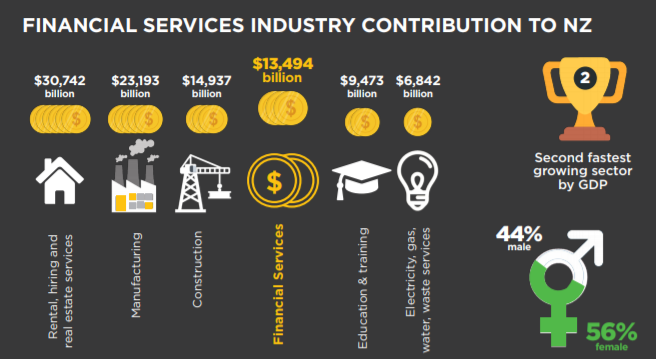

2. The Financial Services sector is the second fastest growing and third largest contributor to economic growth over the past 40 years

The research has highlighted the importance of the Financial Services sector in New Zealand. The sector is the second fastest growing and third largest contributor to economic growth over the past 40 years. It contributed $13.5 billion to GDP in 2017, ahead of agriculture contributing 12.9 billing, transport $10.6 billion and utilities $6.8 billion.

3. The Financial Services Sector is driving diversity and professionalism

The sector employed just over 57,000 people in 2016 – of which 56% were female and a higher proportion were in the 25-49 year old range when compared to other New Zealand industries. The sector has a more educated workforce than average and a similar ethnicity as New Zealand industry as a whole.

4. The growth of the Financial Services sector is regional as well as national

The growth in GDP isn’t just based in the Central Business Districts of Auckland, Christchurch and Wellington. It is spread across the country meaning that the Financial Services industry is contributing to, and supporting, regional GDP growth the length and breadth of New Zealand.